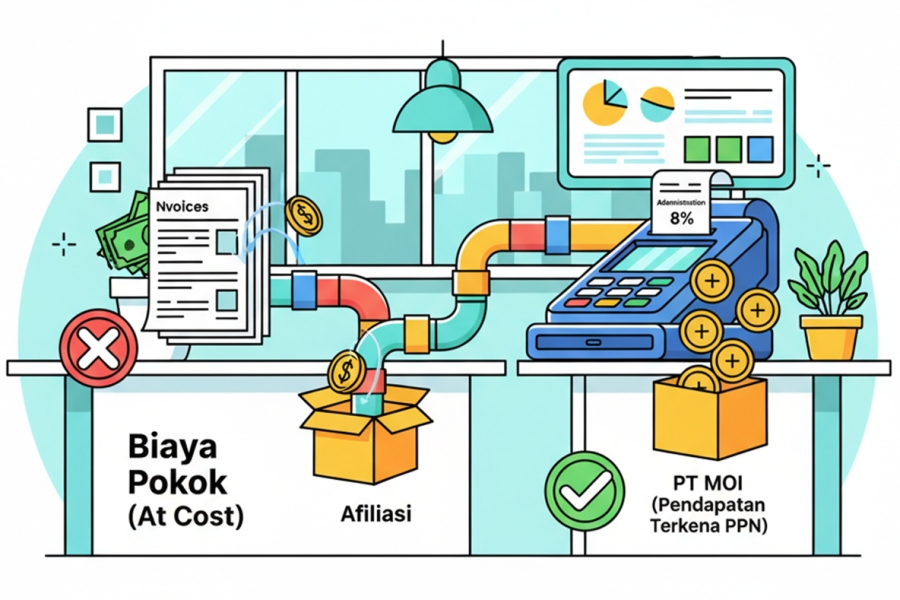

The Directorate General of Taxes (DGT) corrected the VAT Tax Basis (DPP) by assessing that the reimbursement invoice between PT MOI and its affiliates contained the provision of services subject to VAT. The DGT's argument was based on the fact that the invoices billed salaries and accommodation costs on behalf of affiliated employees/technicians working for the same group. Based on this information, the DGT concluded that all reimbursements constituted "reimbursements" subject to VAT and should be collected by the company itself.

Conversely, PT MOI asserted that the transactions were pure reimbursements. The principal costs were recorded not as revenue but as receivables to be reimbursed at cost to the affiliates. Meanwhile, the 8% administration fee was billed through a separate invoice, recognized as revenue, and subject to VAT. With this structure, PT MOI acted solely as a payment intermediary (pass-through), not as a service provider for the principal cost component.

PT MOI's bookkeeping pattern consistently records incurred costs as temporary receivables, then reclassifies them to the main accounts receivable account for collection at the end of the month. When collecting the 8% fee, PT MOI issues a Tax Invoice for the fee. When payment is received, PT MOI's records separate the settlement of the principal cost receivable from the VAT on the fee, ensuring a clear "advance-recovery" flow in the books.

Evidence in court supported PT MOI's argument, proving that the principal cost was recorded at Rp144,668,548, the 8% administration fee at Rp11,573,456, and the VAT on the fee at Rp1,157,346. All amounts appear sequentially in the receipts, indicating that only the fee is subject to VAT, not the principal cost billed at cost.

The Directorate General of Taxes (DGT) assessed the existence of third-party documents in PT MOI's name, the crediting of Input Tax, and the presentation of the fee as part of a service package. However, the Panel held a different opinion, with the operational narrative indicating that the costs arose from an affiliated project, and PT MOI only covered the salaries and travel expenses of employees assigned to assist with the project without a markup. The 8% fee stands alone as an administrative fee for the reimbursement process and has already been subject to VAT. Therefore, the existence of the fee does not automatically constitute a VAT-deductible item (DPP) because the two have separate economic characteristics.

The Panel considered that accounting evidence showed no transfer of BKP/JKP to the base cost because the charge only transferred the costs to the third party that were deferred. Second, VAT had been collected on the administrative margin, so if the base cost were also taxed, it would result in double imposition, contrary to VAT principles. Therefore, the correction of the DPP VAT for the reimbursement is untenable.

The Panel also emphasized that the types of costs reimbursed—airline tickets, tolls, parking, phone credit, rent, BPJS, Jamsostek, medical outpatient services, salaries, and employee insurance—are services exempt from VAT under Article 4A paragraph (3) of the VAT Law. This means that even though these costs were incurred by PT MOI, they were not, in substance, subject to VAT when reimbursement was made at cost.

The practical implication for taxpayers of this ruling is that a clear separation between the principal costs billed at cost and the administrative fees, which are subject to VAT, must be properly documented.

A comprehensive analysis and the Tax Court's decision on this dispute are available here.